Keywords: Global Financial Crisis

There are more than 200 results, only the first 200 are displayed here.

-

ECONOMICS

- David James

- 01 April 2020

4 Comments

The world-wide chaos caused by the outbreak of the coronavirus has underlined a lesson that was only partly learned in the Global Financial Crisis of 2008. In a more interconnected world the understanding of system-wide risk needs to be much better than it is.

READ MORE

-

AUSTRALIA

It’s a stressful and anxious time for many people. Yet, the expression to ‘look for the helpers’ whenever a crisis occurs is an apt one in this situation. People are looking for social connectivity and ways to express kindness to others in practising social distancing under direction of medical experts.

READ MORE

-

ARTS AND CULTURE

- Deborah Singerman

- 15 March 2020

2 Comments

I still mainly look back. The bushfire legacy lives on. It acts as a benchmark for assessing tragedy and hope. I cannot get the searing images out of my head of red, angry skies, of flames raging frighteningly, embers flying, and firefighters miraculously persevering against the odds.

READ MORE

-

ECONOMICS

- David James

- 03 March 2020

10 Comments

We live in an era of hyper-transactionalism, whereby most of what we do is subject to the exchange of money and market pricing. Whereas in the past much of humanity was bound to a political system, now most of us are bound to a globalised monetary system.

READ MORE

-

RELIGION

- Tim Robertson

- 27 February 2020

16 Comments

Contrary to their claims, the New Atheists do have a creation myth. It goes something like this: emerging from darkness into the light, Enlightenment thinkers cast off the shackles of religion and, in so doing, ushered in an age of reason. For the likes of Richard Dawkins, a founding member of the movement, this is an article of faith, and he’s spent recent years casting himself not just as an heir of this tradition, but also as its modern day guardian.

READ MORE

-

ECONOMICS

- David James

- 04 February 2020

3 Comments

A shift is afoot in the west's financial markets that represents the most important economic change since the emergence of the new financial instruments in the 1990s that ultimately led to the global financial crisis. It is likely to result in a new way of thinking about money, which will change the substructure of developed economies.

READ MORE

-

ENVIRONMENT

- Tim Hutton

- 07 January 2020

43 Comments

Here is why the Morrison government was so slow off the mark: to acknowledge the unprecedented nature of these fires is to concede that there is something happening to the climate. The only way to downplay the reality of climate change, was to downplay the severity of the fires themselves.

READ MORE

-

ECONOMICS

- David James

- 22 November 2019

5 Comments

At the next global financial crisis, when questions about what we want our monetary system to do for us become a matter of survival, why not devise a transactional system that is not just geared towards the consumption of goods and services, but involves monetary exchanges for social goods, such as sustainable production, or civic benefit?

READ MORE

-

ECONOMICS

- David James

- 21 October 2019

5 Comments

Recognising that financial systems are a human creation rather than natural systems governed by 'capital flows' would be an important step to conceiving a more robust and equitable system. To ask what kind of society we want and only then work out what we want money to do for us is to put the horse back in front of the cart.

READ MORE

-

AUSTRALIA

- Joe Zabar

- 18 October 2019

3 Comments

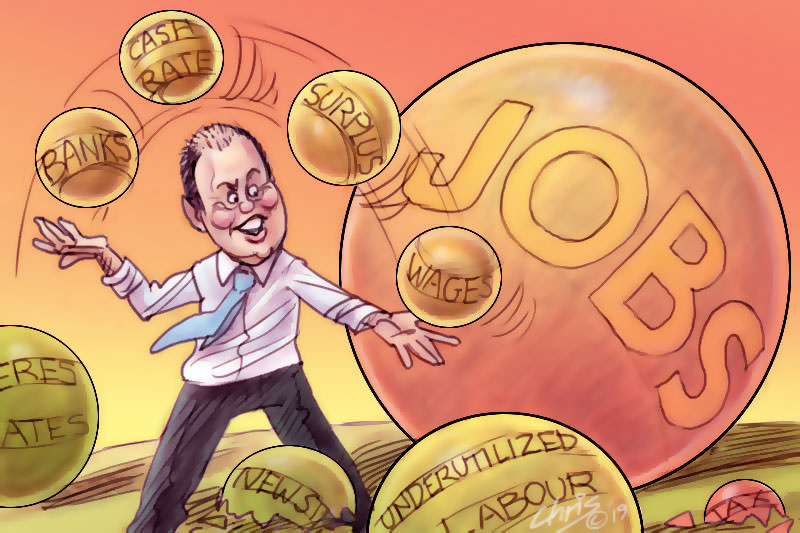

Treasurer Josh Frydenberg's attack on banks for failing to pass on the full rate cut to consumers is a political distraction. There are two clear signals coming out of the latest cut. First, monetary policy is not enough to spark a revival of the economy. Second, it's now all about jobs. Frydenberg and his officials would be wise to heed these signals.

READ MORE

-

ECONOMICS

- David James

- 24 September 2019

9 Comments

It is easy to blame the financial sector — and the governments that were supposed to oversee the financial system but instead just washed their hands of it — for creating this global debt debauch. They certainly bear much of the responsibility. But in many ways the financial misbehaviour is as much symptom as cause.

READ MORE

-

ECONOMICS

- David James

- 07 September 2019

6 Comments

One of the ironies of the intensifying tariff war between America and China is that that neither of the two giants seems to have a viable economic model. Both countries' systems are based on dodgy financial engineering and printing money, or just inventing new types of money out of thin air.

READ MORE